PDF editing your way

Complete or edit your irs form 709 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 709 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 709 gift tax return as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your united states gift tax by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 709

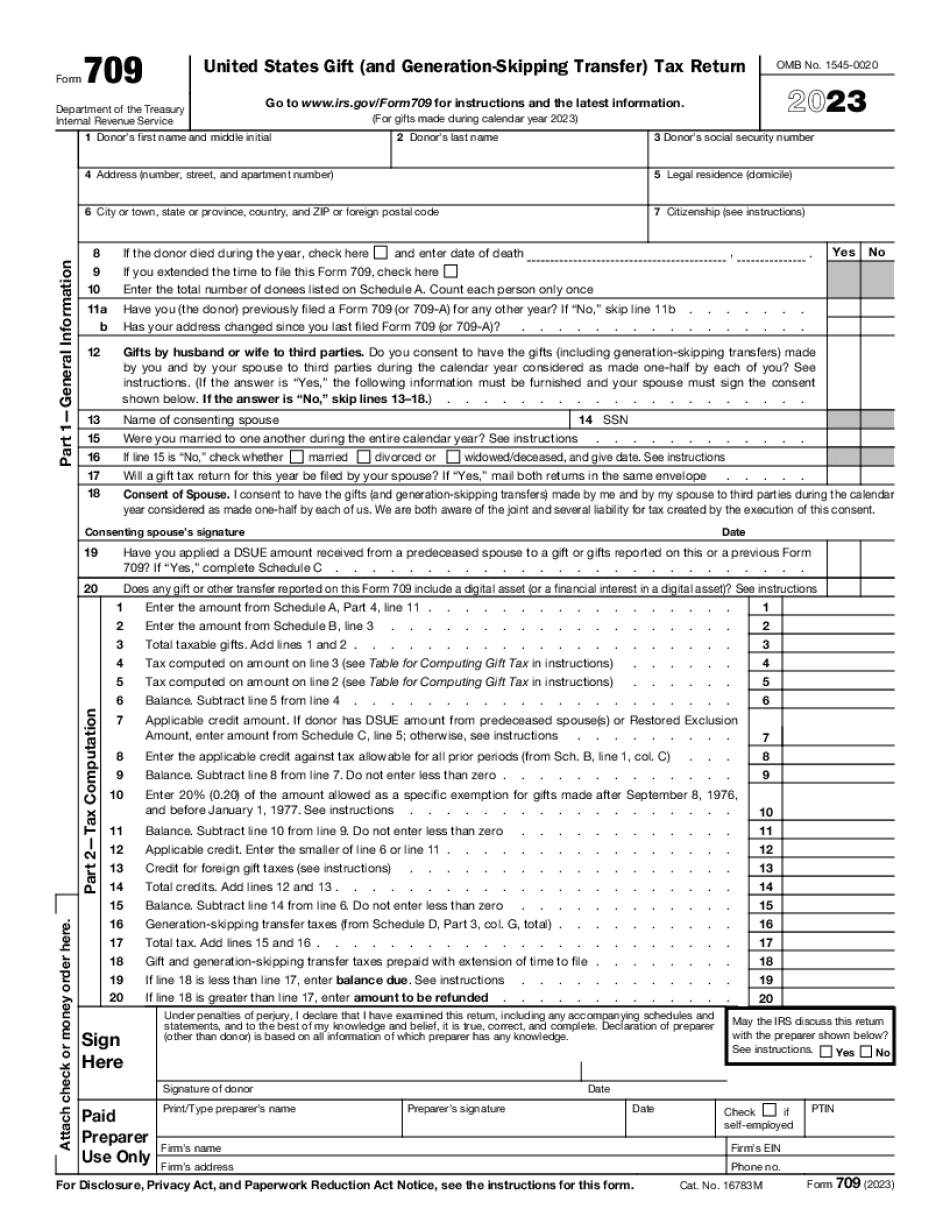

About Form 709

Form 709 is a federal tax form used to report gifts made during a person's lifetime that exceed the annual exclusion amount (currently $15,000 per person per year as of 2021) or gifts to non-US citizen spouses that exceed the annual exclusion amount. Individuals who gift above the annual exclusion amount will need to file Form 709, even if they do not owe any gift tax. Additionally, if a person gifts to their non-US citizen spouse, they may also need to file Form 709 regardless of the gift amount. The purpose of this form is to keep track of a person's lifetime gifts and determine if they have exceeded the lifetime gift and estate tax exemption amount, which is $11.7 million per person as of 2021.

What Is Form 709?

In the U.S. all the individuals have to pay different taxes on regular basis. The type of such charges depends on person`s activity. However, there are some misunderstood taxes, such as a federal gift one. It must be paid in case an individual transfers his/her property or cash to a recipient as a gift. For instance, when someone dies and leaves their estate or money to beneficiaries. In this case it is required to prepare a Form 709, Gift Tax Return. In this article you will find a short guide for preparing a sample as well as cases when it is required.Before you start creating a 709 Form sample, you need to check if you have to. Note that not each transfer requires payment of taxes. Here you will find the list of cases when a blank is needed:

- you gave gifts to someone totaling more than $14,000 (other than to your spouse);

- you made transfers called future interests;

- you need to split gifts with your spouse;

- you gave property held by both you and your spouse;

- you are an individual only.

If you fall within one of the above-mentioned categories, you have to fill out a blank and file it with the IRS.

The fillable template is a one-page document that comprises two parts. To create it saving time and effort we offer you to try an editable blank that can be prepared online in minutes. Save a completed file to your device or print out in no time. Find below the details you need to furnish:

- general information (donor`s name, address, citizenship, SSN, marriage details, date of death etc.);

- tax computation.

The document also includes four schedules that should show information about real estate or money transferred.

A final Irs 709 paper must be signed by a donor or his/her spouse. Sign a document electronically by typing, drawing or capturing your signature with a webcam.

Online remedies enable you to arrange your doc management and supercharge the productiveness of your workflow. Go along with the short information as a way to full Form 709, stay clear of problems and furnish it in a well timed method:

How to finish a Irs Form 709?

- On the website aided by the type, simply click Start out Now and move to your editor.

- Use the clues to complete the related fields.

- Include your individual facts and speak to knowledge.

- Make certain that you just enter accurate information and facts and quantities in correct fields.

- Carefully verify the subject matter within the form at the same time as grammar and spelling.

- Refer to help you part for people with any problems or deal with our Assist staff.

- Put an digital signature on the Form 709 along with the assist of Signal Device.

- Once the form is finished, press Finished.

- Distribute the ready variety by using e-mail or fax, print it out or help save in your gadget.

PDF editor allows you to definitely make changes in your Form 709 from any online world related equipment, customize it as per your requirements, sign it electronically and distribute in numerous strategies.